capital gains tax rate california

There is a progressive income tax with rates ranging from 1 to 133 which. Capital gains tax rates on most assets held for less than a year correspond to ordinary income tax brackets 10 12 22 24 32 35 or 37.

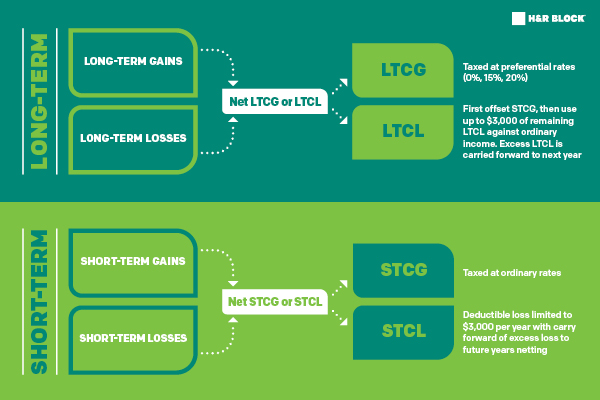

How Capital Gains Affect Your Taxes H R Block

California does not have a lower rate for capital gains.

. It was announced that long-term capital gains beyond Rs 1 lakh from stocks equity funds to be taxed at 10. Add the 38 net investment tax under Obamacare and you have 238. 襤 In 2019 and 2020 the capital gains tax rates are either 0 15 or 20 for most assets held for more than a year.

There is a progressive income tax with rates ranging from 1 to 133 which are the same tax rates that apply to capital gains. The Tax Foundation estimates the loss more likely would be. California is generally considered to be a high-tax state and the numbers bear that out.

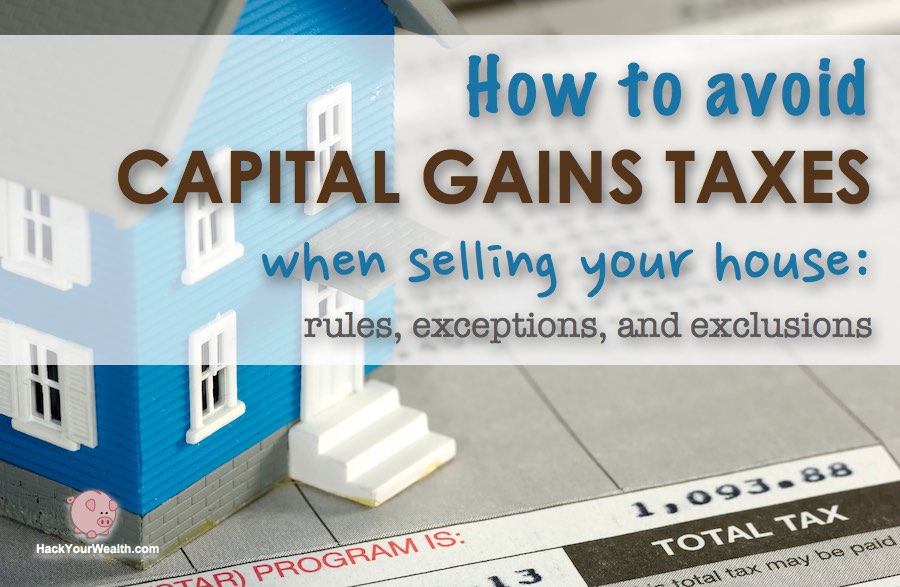

This includes the state income tax and the federal capital gains tax. When your house is put under contract capital gains tax rates apply and this means that you will pay taxes on the amount earned after selling. Your gain from the sale was less than 250000.

The capital gain rates vary between different buyers. In total the marginal capital gains tax rate for California taxpayers is 33. This is maximum total of 133 percent in California state tax on your capital gains.

If your income was between 0 and 41675. These California capital gains tax rates can be lower than the federal capital gains tax rates which are 0 15 and 20 for long-term gains assets held for more than a year. Individual Income Tax Return IRS Form 1040 and Capital Gains and Losses Schedule D IRS Form 1040.

The IRS will charge you a capital gains tax on your California home sale and so too will the state of California through its Franchise Tax Board FTB. Theyre taxed at lower rates than short-term capital gains. What is the capital gains tax rate for California.

Individual income tax return irs form 1040 and capital gains and losses schedule d irs form 1040. The capital gains tax rate california currently plans for is one that can vary widely. If you have a difference in the treatment of federal and state capital gains file.

How to report Federal return. The capital gains tax rate california currently plans for is one that can vary widely. These California capital gains tax rates can be lower than the federal capital gains tax rates which are 0 15 and 20 for long-term gains assets held for more than a year.

All capital gains are taxed as ordinary income. For 1 million earners in high-tax states rates on capital gains could be above 50. Discover Helpful Information and Resources on Taxes From AARP.

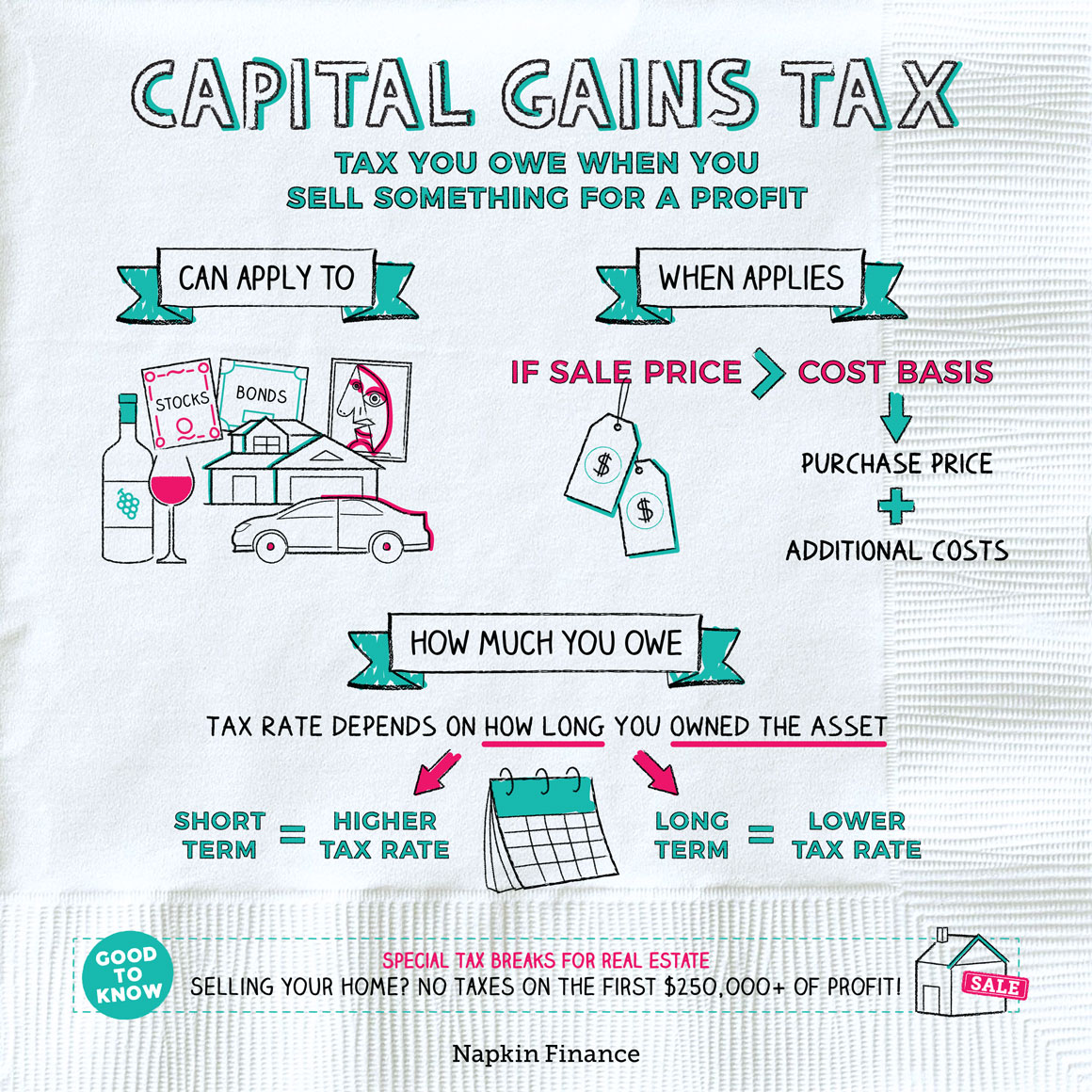

This means your capital gains taxes will run between 1 up to 133 depending on your overall income and corresponding California tax bracket. The federal capital gains tax rate is 0 to 15 for most taxpayers with higher earners paying as much as 20. Long-term capital gains are gains on assets you hold for more than one year.

The FTB sticks to IRS rules on capital gains taxes for the sale of a home and follows the same exemptions. California income and capital gains tax rates Tax rate Single Married filing jointly 1 Up to 8932 0 to 17864 2 8933 to 21175 17865 to 42350 4 21176 to 33421 42351 to 66842 6 33422 to 46394 66843 to 92788. 4 rows The capital gains tax rate California currently plans for is one that can vary widely.

California Finance Lender loans. What is the California state capital gains tax rate. You do not have to report the sale of your home if all of the following apply.

Because California does not give any tax breaks for capital gains you could find yourself taxed at the highest marginal rate of 123 percent plus the 1 percent Mental Health Services tax. Simply so what is the capital gains tax rate for 2019. The capital gains tax rate is in line with normal California income tax laws 1-133.

California income and capital gains tax rates. Ad Compare Your 2022 Tax Bracket vs. You owned and occupied the home for at least 2 years.

10 rows California is generally considered to be a high-tax state and the numbers bear that out. 襤 Click to see full answer. Any gain over 250000 is taxable.

By paying 238 plus 13. You have not used the exclusion in the last 2 years. Determining Your 2020 California Income Tax Rates.

In the state the effective average tax rate is 073 compared to the US. Gst tax rate begins at 5 per cent and the tax rate begins at seven percent. Your 2021 Tax Bracket to See Whats Been Adjusted.

To report your capital gains and losses use US. If the home was owned for a period of time greater than one year the. The federal government taxes long-term capital gains at the rates of 0 15 and 20.

The long-term capital gains tax rate is 0 15 or 20 depending on your taxable income and filing status. The difference is that the federal capital gains tax rates only apply to taxable income above 425800 for single filers or 481601 for joint filers. 9 rows With California not giving any tax breaks for capital gains you could find yourself getting.

Capital gains tax is expected to be increased to 288 per cent by house democrats. California does not tax long term capital gain at any lower rate so Californians pay up to 133 too. Depending on your regular income tax bracket your tax rate for long-term capital gains could be as low as 0.

This is the highest marginal capital gains tax rate in the United States. Even taxpayers in the top income tax bracket pay long-term capital gains rates that are nearly half of their income tax rates. If the house has been owned for less than a year there will be a 15 capital gains tax applied.

2022 Income Tax Brackets And The New Ideal Income For Max Happiness

Avoiding Capital Gains Tax On Real Estate How The Home Sale Exclusion Works 2021

How To Offset Capital Gains H R Block

San Diego Capital Gains Tax On A Second Home In 2022 Capital Gains Tax Capital Gain San Diego

How Does California Tax Your Capital Gains Financial Planner Los Angeles

Capital Gains Tax Guide Napkin Finance

How To Calculate Capital Gains Tax H R Block

How Does California Tax Your Capital Gains Financial Planner Los Angeles

Should You Be Charging Sales Tax On Your Online Store Tax Sales Tax Filing Taxes

2022 Income Tax Brackets And The New Ideal Income For Max Happiness

How To Calculate Capital Gains Tax H R Block

2022 Income Tax Brackets And The New Ideal Income For Max Happiness

How High Are Capital Gains Taxes In Your State Tax Foundation

2021 Capital Gains Tax Rates How They Apply Tips To Minimize What You Owe

How To Pay 0 Capital Gains Taxes With A Six Figure Income

2021 Capital Gains Tax Rates How They Apply Tips To Minimize What You Owe

Capital Gains Tax Rate In California 2022 Long Short Term Seeking Alpha

Avoiding Capital Gains Tax On Real Estate How The Home Sale Exclusion Works 2021